sdg.market

A Decentralized Market to Incentivize Sharing Knowledge and Expertise for the UN SDGs

Introduction

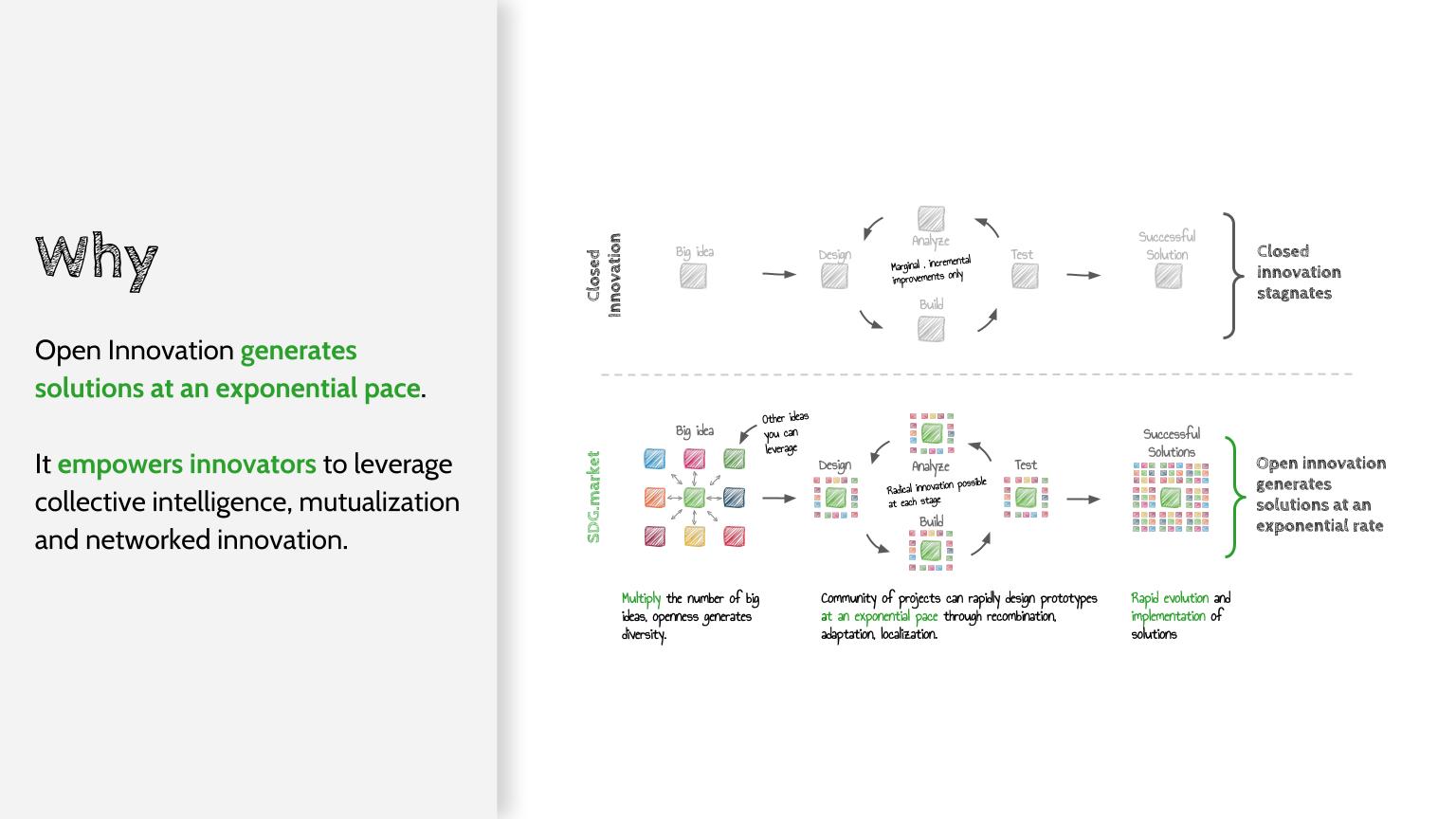

We recognize the prime importance of transparency, attribution and accountability of knowledge production. We consider that the progress of humanity at scale requires strong incentives to produce, share and operationalize knowledge through actions, systems, products. These artifacts can then have a positive impact in order to overcome some of the most pressing challenges of our times (e.g., climate change, gender equality, reduction of poverty). The challenge of collective knowledge production entails most often latent social and economic components. For instance, contributors to Open Source Software (OSS) or Wikipedia resort to a mix of intrinsic and extrinsic motivations that determine their engagement []. Involvement in peer-production generally requires understanding a set of more or less implicit norms, which cement the community yet often at the cost of some entry barriers. Most open source projects have suffered from these barriers [ref].

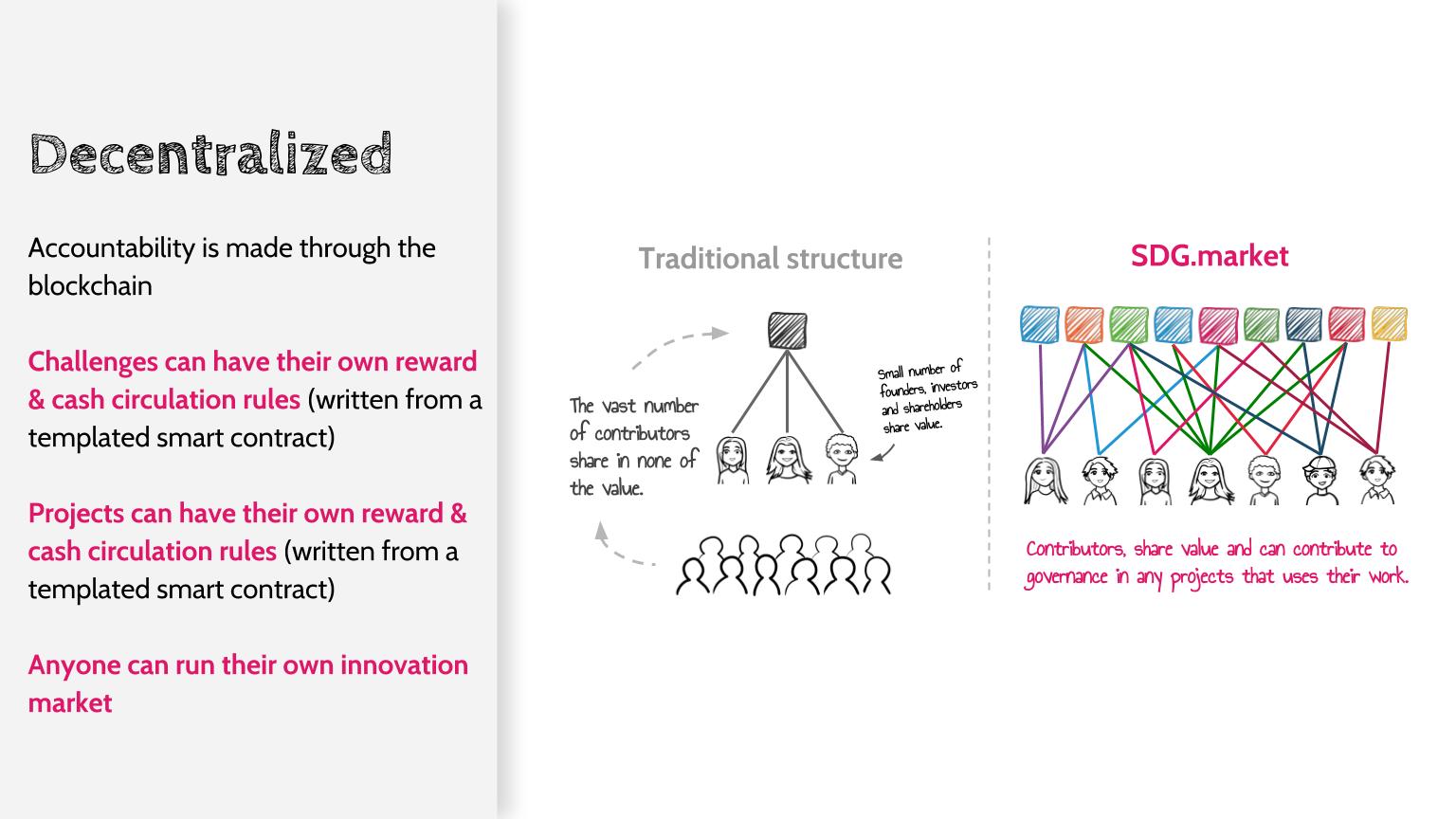

Here, we propose that at least some of the motivations and norms are fungible in a decentralized mechanism design (a market blueprint), which in turn would create new scaling opportunities, in particular by reaching broader communities of contributors, who are not necessarily tuned to the subtleties of open source explicit and implicit rules, yet may wish to contribute to and “be part” of projects that have the potential to help overcome challenges they particularly care of.

In this whitepaper, we propose a (decentralized) mechanism design to fulfill the requirements of open source yet with a fair attribution of the value of contributions to projects by individuals over the course of a project. This fair attribution shall become fungible with real (or virtual) currency when investors start pledging/pledging money in the contributed project.

Background

- markets as a driver for trust : people make contracts

- Adam Smith

- crypto currencies

- the devil lies in details : full transparency of the market design in this white paper

the UN SDGs

The 17 United Nations (UN) Sustainable Development Goals (SDGs) have set an agenda to make the world more sustainable by 2030. The SDGs follow the Millennium Goals, which were set for the period 2000 until 2015.

Here, we believe that sharing and exchanging valuable open knowledge as well as expertise associated with concrete projects aimed at the SDGs, is a way to go that empowers all people willing to contribute.

We also believe that market mechanisms can help bring enough incentives and motivation for people to share knowledge and contribute collectively to the concrete achievement of projects aimed at addressing outstanding issues associated with the SDGs.

We further believe that if such SDG Market should exist, it should be transparent, decentralized. It should as much as possible avoid intermediaries. However, we keep in mind that there is no one-size-fits-all solution to efficiently sharing knowledge. The SDG Market Project borrows from past and ongoing & experiences on fast and efficient knowledge sharing.

We aim to establish a common scalable platform to share knowledge for SDGs.

This draft White Paper has come out discussions with Dev4X held at the iSDG Assembly 2017 in Shenzhen, which gathered high-school students from Beijing with their teachers, university students attending Summer School programs at Tsinghua University, University of Geneva, EPFL, Centre pour la Recherche Interdisciplinaire (CRI) and Harvard University.

Context/Requirements :

Motivations

The 2015-30 agenda for the implementation of the UN SDGs is a tight one. It will require unleashing as much creativity, innovation and performance to find, develop and spread most sustainable technologies. We believe that it will require the involvement of large crowds committed together. To encourage cumulative innovation, knowledge shall spread quickly to most concerned people around the world, and entice them to contribute further.

Set clear, fair, transparent and immutable incentives to contribute

- fully open innovation

- transparency

Encourage community building & sustainable transmission across generations of contributors

- respect individual and collective strategies

- maximize opportunity for contributors

Focus on Robustness & Scaling

- peer review with consensus building

Objective measures of success

- objective measure of success : survival x impact ?

Incentivize the enforcement of intellectual property

- build trust for contributors that their contributions will be factored in the compounded value created in the end

- establish a new IP regime that reflect stakes on the SDG Market (i.e., a new kind of open source license)

Project Dynamics :

An (open source) project starts with an idea, which is either devised collectively or by a single leading person who then convinces others to follow, and help contribute. As it grows the project gets more contributors, who in turn help fix an increasing number of issues, and provide additional flesh to the project. Hopefully, the project continues this way following a virtuous circle. Even though it may not generalize, most projects that aim to scale may deeply benefit from contributors with different culture and expertise backgrounds. Additionally, the nature of involvement is likely to change over the course of the project: late contributors generally don’t have the same challenges, motivations and constraints, compared to early contributors. Respecting the life course of a project and the renewal of contributors is paramount to ensure that resources provided by contributors are efficiently allocated over the course of the project.

An (open source) project starts with an idea, which is either devised collectively or by a single leading person who then convinces others to follow, and help contribute. As it grows the project gets more contributors, who in turn help fix an increasing number of issues, and provide additional flesh to the project. Hopefully, the project continues this way following a virtuous circle. Even though it may not generalize, most projects that aim to scale may deeply benefit from contributors with different culture and expertise backgrounds. Additionally, the nature of involvement is likely to change over the course of the project: late contributors generally don’t have the same challenges, motivations and constraints, compared to early contributors. Respecting the life course of a project and the renewal of contributors is paramount to ensure that resources provided by contributors are efficiently allocated over the course of the project.

The need for a robust sense of ownership for all contributors from the idea to the first financial pledge and beyond:

There are actions that count in the life of a project, such as the initial idea, the invitation of new contributors, contribution to content other tasks for project enhancement (e.g., a new module). Some other actions resort to soft skills and altruism, such as bestowing fellow contributors, e.g., to express gratitude.

Additionally, a project gets robust through a thorough peer-review process, which may be fine-grained (reviewing and validating a given task) or taking into account the project as a whole.

Taking the opportunity of “foster” value.

Many projects can sustain for a long while without financial resources, and as such remain “unfungible” during this time. This is usually an issue, because projects/startups without investment don’t have proper continuous valuation. In turn, the lack of valuation prevents attributing value to the fine-grained actions performed by contributors.

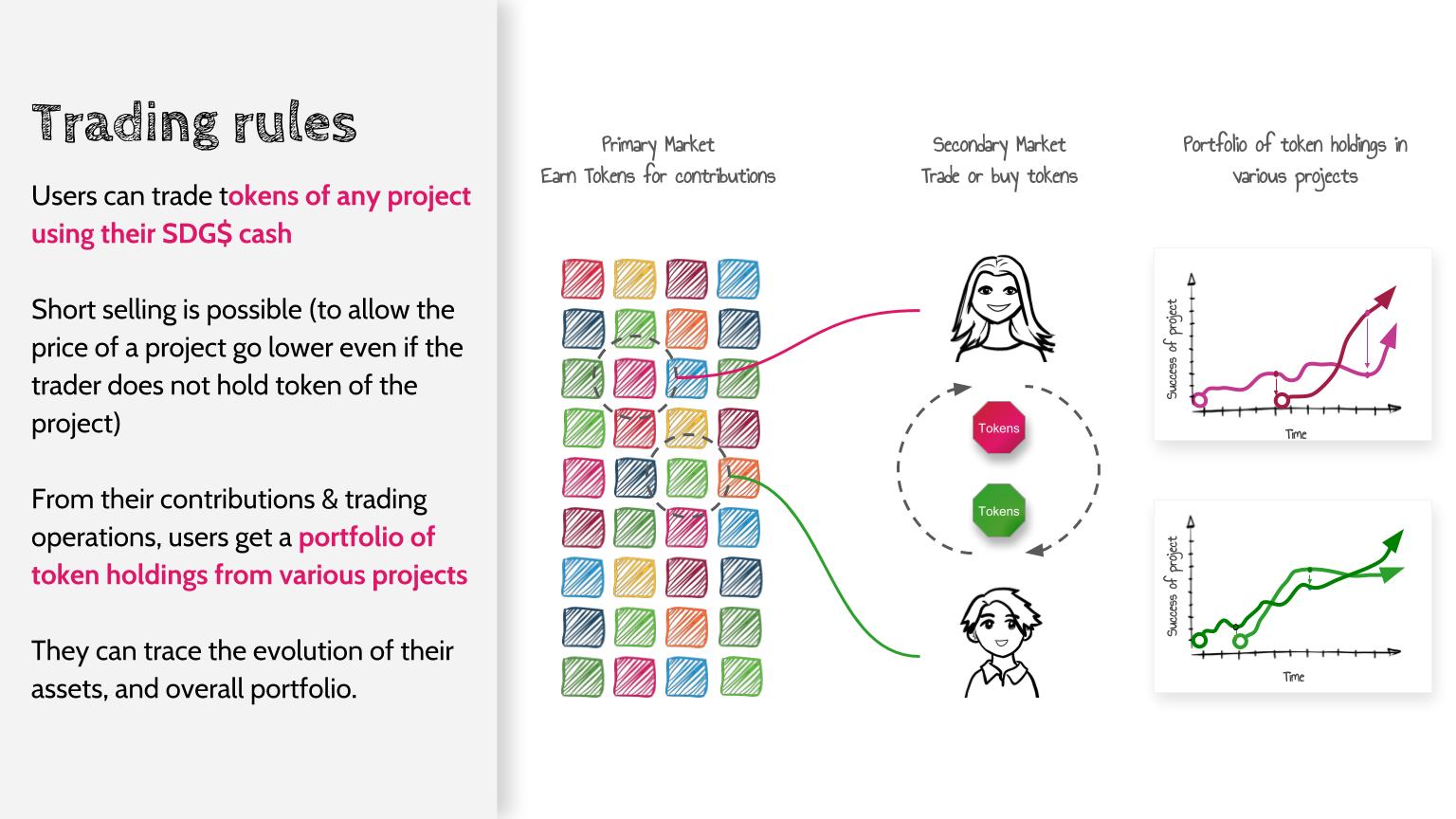

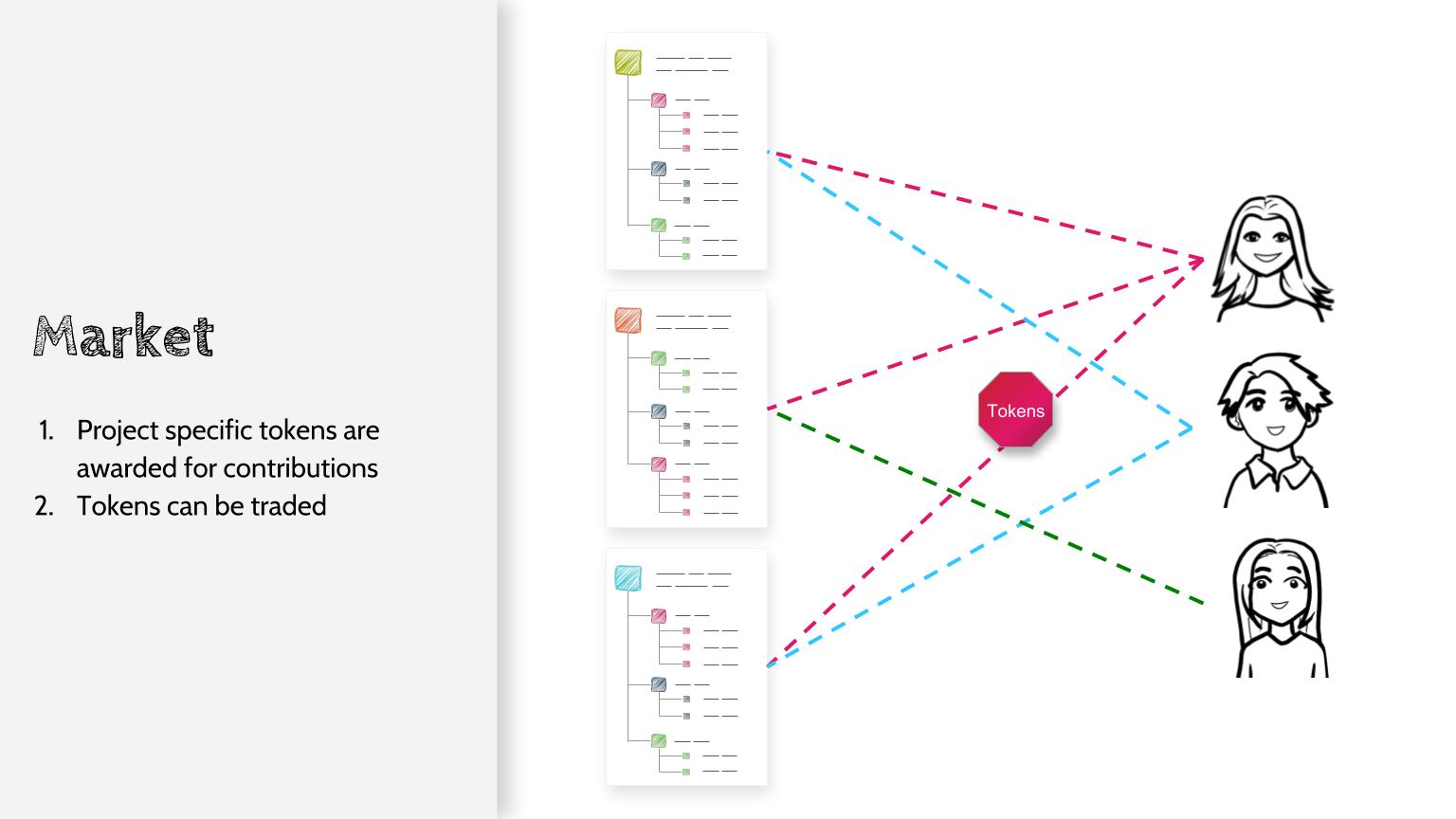

Our core proposition is that contributions to projects (as well as other actions) generate tokens. We will detail in section Rewards for Contributions, Tasks and Actions which actions generate rewards through the generation of tokens. In turn, these tokens can be traded on their “foster” value until proper financing kicks-in (see next section).

This exchange offers the possibility of diversification between projects. Yet, it is arguably complicated for people to decide how to trade tokens one to one. At the same time, there is no currency involved.

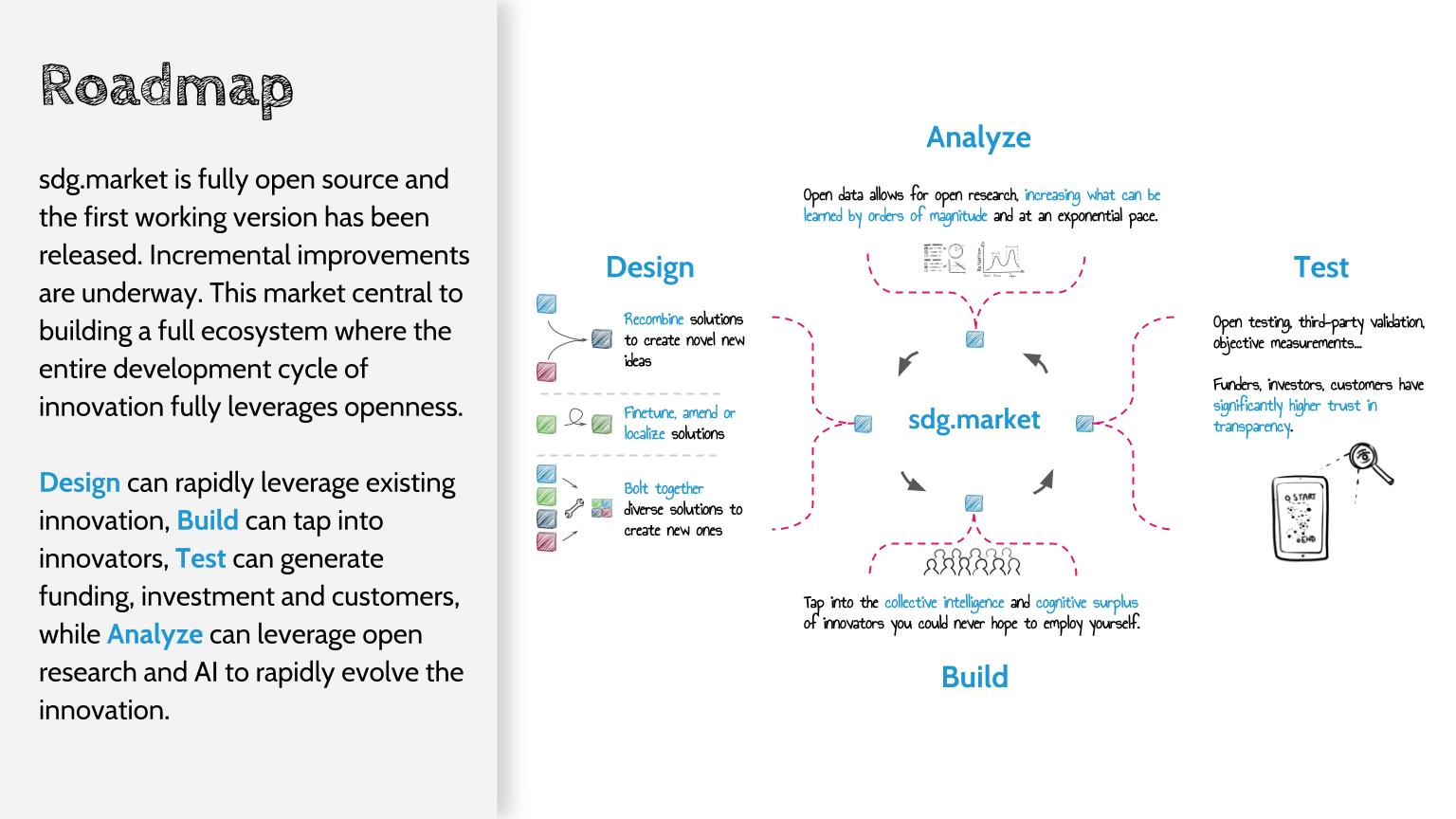

A Smart Contract to define the project and challenge game rules

Every project is unique however in its aims, proceedings and reward mechanisms. We envision that the reward and trading rules of each project shall be coded in a smart contract, issued at the beginning of the project. The smart contract may in particular specify under which license produced contents shall be distributed. Similarly, a challenge (i.e., a group of projects with similar aims and values) shall define which project is acceptable for the challenge. In particular, a challenge may target a specific SDG or sub-SDG.

Every project is unique however in its aims, proceedings and reward mechanisms. We envision that the reward and trading rules of each project shall be coded in a smart contract, issued at the beginning of the project. The smart contract may in particular specify under which license produced contents shall be distributed. Similarly, a challenge (i.e., a group of projects with similar aims and values) shall define which project is acceptable for the challenge. In particular, a challenge may target a specific SDG or sub-SDG.

The project (resp. challenge) smart contract shall in particular determine which kind of investment, it may receive, whether for profit or philanthropic.

the SDG Market and Initial Coin Offering :$

The SDG Market is where tokens of all projects are traded. One can place an offer to buy tokens of a new project in exchange of a fraction (resp. multiple) of token from an existing project.

There is no initial coin offering. As soon as project tokens are generated by contributions and actions, they can be traded on the SDG.market, under condition that the project respects the charter of the SDG Market (i.e. see associated smart contract).

Through transactions performed by participants, the SDG Market essentially plays the role of revealing the “true” value (or at least the perceived value) of projects. It also offers opportunities to invest early in a project without actually contributing or performing actions.

Financing :

At some point, a project may require fund raising. On the contrary to the SDG.Market, which is concerned only with trading tokens, trading may also involve real money (resp. virtual currencies).

The objective of real-money is financing the growth of a project, and marginally, to enrich token holders as well. The question is the following : Each time a transaction with real money occurs, how much of this money should go to the shareholder and how much should go to the project.

There are two options :

- a given amount of tokens are created and distributed to the buyer in exchange of cash. or

- a Tobin tax or a flat commission applies, which revenues go to the project.

-

In the first case, the project (i.e., token holders) decides to create tokens against cash. From the SDG Market, they derive a market value (recursively by considering the market price of the project tokens against other tokens of projects that have already received some cash. The problem is that the decision to create and sell tokens requires an (unknown) form of consensus.

-

The second option is more like a Tobin tax, which neither requires consensus nor token creation. The Tobin tax function is set in the project smart contract. For each transaction involving cash, the buyer must pay an additional fee to the project (or equivalently, a share of her down payment of a given amount of tokens goes to the project). This tax can be factors more than the value of the shares, and may actually evolve with the value of tokens. Several mechanisms may be possible : a. it can be a flat rate per share, e.g., 1 CHF per token sold. For low value tokens, the price to pay is high, which is punitive, yet could bring cash to a project in difficulty. So for instance, if a token holder sells 10 tokens for 1 Swiss Francs, the per token tax may be 10 CHF (100%). On the contrary, if the token holder sells 1 token for 10 Swiss Francs, the tax is 1 CHF (10%). b. it could be a flatrate tax on the transaction : 10 CHF whatever transaction. It’s even more punitive because it forces large volumes, unlike option (a), which is punitive on the number of tokens exchanged. c. it could be a percentage (e.g. 1%), but this may over incentivize early cash inflow

-

The third option is an hybrid of 1 and 2a. : For each transaction, some tokens are distributed as a counterpart of the tax (it’s technically no longer a tax). For each transaction there is flat rate to pay per share to pay to the project, e.g.. 1 CHF per token. As a counterpart, a fraction/multiple of token is distributed as the inverse function of the current token value. For instance, if the token value is 1 CHF then the buyer receives 1 new token. If the value is 10 CHF, then the buyer receives 0.1 token. If the value is 100 CHF, then the buyer receives 0.01 token. And so on. This mechanism is particularly nice because it helps someone buy out quickly an abandoned project, also bringing in cash resources, and thus, reviving interest in the project.

Creating a SDG Commitment:

SDG Token Signature:

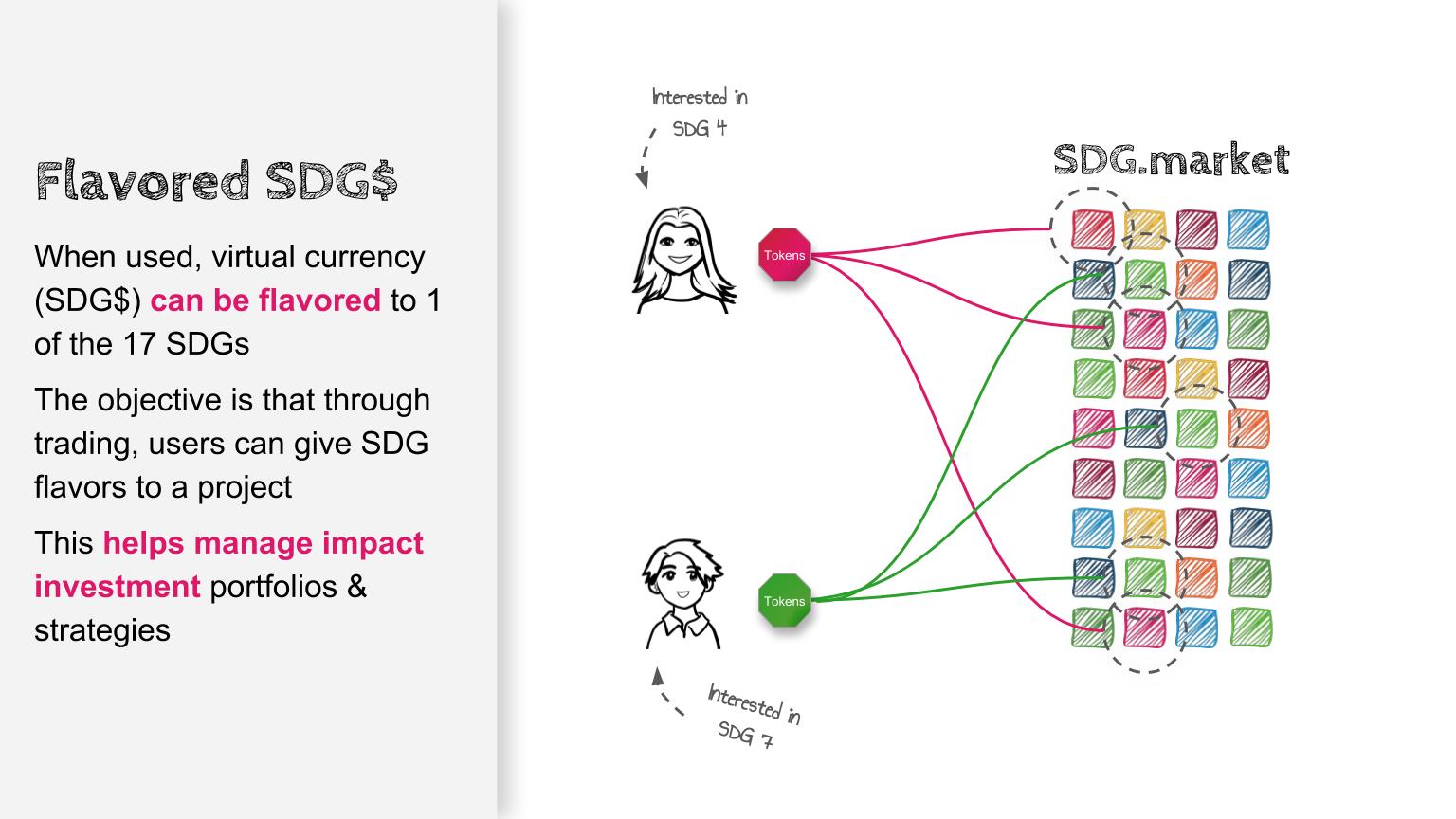

The SDG Market is about pushing impact investment to make the world a better place. In the description so far, it was assumed that projects respect the SDGs, but no commitment is enforced. Signing tokens with a basket of SDGs would be the “SDG Signature” of a project.

The SDG Market is about pushing impact investment to make the world a better place. In the description so far, it was assumed that projects respect the SDGs, but no commitment is enforced. Signing tokens with a basket of SDGs would be the “SDG Signature” of a project.

In terms of SDG commitment, a project may define itself as SDG_{1-17}={0.,0.3,0.5,0,0,0.1,…,0.2}, with a vector reflecting the SDG aims.

This approach is problematic as the SDG flavors may change as the project evolves. Hardcoding in a smart contract is not desirable. Therefore the alternative proposition below.

SDG Investment Signature:

Another way is to let the investors decide what SDG flavor a project has. Let’s consider that a cash investor may want to trade with a project that she has identified with a “gender equality” flavor. By making her investment, she signals a project as important for gender equality (SDG 5). Another investor may decide that the same project is important for water sanitation (SDG 6), and shall invest in proportion of her beliefs. The proportion of cash investments shall signal the SDG flavor of a project, and the evolution of its SDG Flavor over time, as people invest and divest from a project when selling tokens for investments with different flavors.

The investor may at any time “taint” a cash investment with only one SDG. And in some cases, the counter part shall only trade is a specific unique flavor. The token exchanged against cash remains “tainted” with a unique SDG flavor until it gets sold against another cash investment. So a token flavored with SDG1 may be traded against cash flavored with SDG5, and will become SDG5 flavored as a result.

Tokens on the exchange market (not involving cash but only exchanging tokens) can be exchanged with no condition, as it is primarily aimed a portfolio diversification for content contributors.

Impact Investment :

The SDG Investment Signature signals clearly how investors rate projects according to the SDGs. In turn, by repeated trading of projects with various SDG flavors, the wisdom of crowds exhibits how projects behave according to the SDGs, and thus, inform further investment in one direction or another. A financial organization may invest/divest according to the SDG Signal, and as a result, follow its responsible investment portfolio, respectively its investment statutes.

Non-Profit Impact Investment :

There is a growing interest in non-profit impact investment, and an organization with provision to invest only in non-profit shall be entitled to do so. To be eligible to non-profit investment a project shall include a “non-profit” statement in its smart-contract, and tokens sold/emitted shall be traded for cash coming from non-profit organizations. These “non-profit” tokens can only be traded against other “non-profit” tokens.

By default (strict), the “non-profit” cash shall be entirely transferred to the project address. A relaxed rule may involve that in order to incentivize transaction, the seller gets a fixed haircut of the transaction (e.g., 5-15%). This haircut is defined in the smart contract. As an alternative to a fixed percentage (or even fixed rate), it could be a concave (to incentivize transactions at low price) or a convex function of price (to incentivize transactions at high price).

The takeaway for non-profit organizations is the transparent signaling of their non-profit impact investments, and their clear evolution of time.

Rewards for Contributions, Tasks and Actions :

The primary way to generate tokens is through active contribution to projects. Every action shall be rewarded at some pre-defined rates. Here, we detail some “simple” as well as more sophisticated possible rules. These are propositions that explain the mechanisms, but in the end, the objective would be that each project’s smart contract shall contain its own contribution reward rules.

Simple Rule

The simple rule involves no bargain on the value of performed task. It relies uniquely on the quantity of change made by an individual to a project. To make it simple and considering only written text (incl. code), one may consider a project as a long list of characters. This long list of characters changes at each contribution. The minimum number of character permutations to transform string1 into string2 (i.e., Levenshtein function) shall measure this quantity of change.

A given quantity of change shall be rewarded with a quantity of tokens, as a function of current token value. So assuming that a project starts at value 100 #SDGs (with the #SDGs being the base (virtual) currency unit of the SDG.Market), then a change of 100 bytes shall be rewarded with 1 token. If the value of the project increases to 1000 #SDGs then the same contribution shall be rewarded 0.1 token. On the contrary, if the value soars to 10 #SDGs the same 100 bytes contribution is rewarded 10 tokens.

share_attribution = bytes x value / price

Multimedia files (image, video, sound) may be at some point counted with a somewhat similar approach, yet it may be a little more complicated. One may give a reward per size or a flat reward or no reward assuming that the flesh of the content is in the text, as a thorough explanation of the media in the caption (the main text).

Simplicity is a huge advantage because it does not require any ex-ante or ex-post bargain on the value of contributions. Yet, it probably requires that contributors shall be co-opted in a way or another. Often, open sources projects are organized with 3 hierarchical levels: lurkers and bug fixers (usually no right to contribute directly), main contributors, administrators. One fix a variety of rules that decide how contributors escalate. It may be as simple as an administrator deciding who get main contributor or administrator privileges.

- short selling (add q description on this)

We see collective intelligence as a social process, which involves contributors proposing their changes (similar to pull request) or being invited to perform a contribution.

Proposition to Make a Contribution

If not granted rights to contribute directly, a lurker may find some changes to be made to a project. To avoid spam, the lurker must pay a fee in #SDGs representing 0.1% of the project value at the time of posting. If the proposed changes (pull request) are accepted by a main contributor, then the lurker gets a load of shares according to the above formula (1) valued at the time of posting the contribution + a fee reimbursement of 0.1% of the current project value.

A response is expected within a week (or any other time period which could be defined in the project smart contract).

If no response is issued, the lurker gets back 90% of its fee as shares as valued at max(value at posting time,current project value) from main contributors altogether (i.e., the fee is divided between all main contributors).

If a negative response is issued by a main contributor, then all main contributors must pay together a 0.05% fee in shares (at max(value at posting time,current value), i.e., the fee is divided between all main contributors) to the lurker. In other words, if a contribution request is turned-down everyone is punished. With an incentive for main contributors to act fast as fee reimbursements are made at current value, as it is expected that the project value will increase.

Invitation to Perform a Contribution

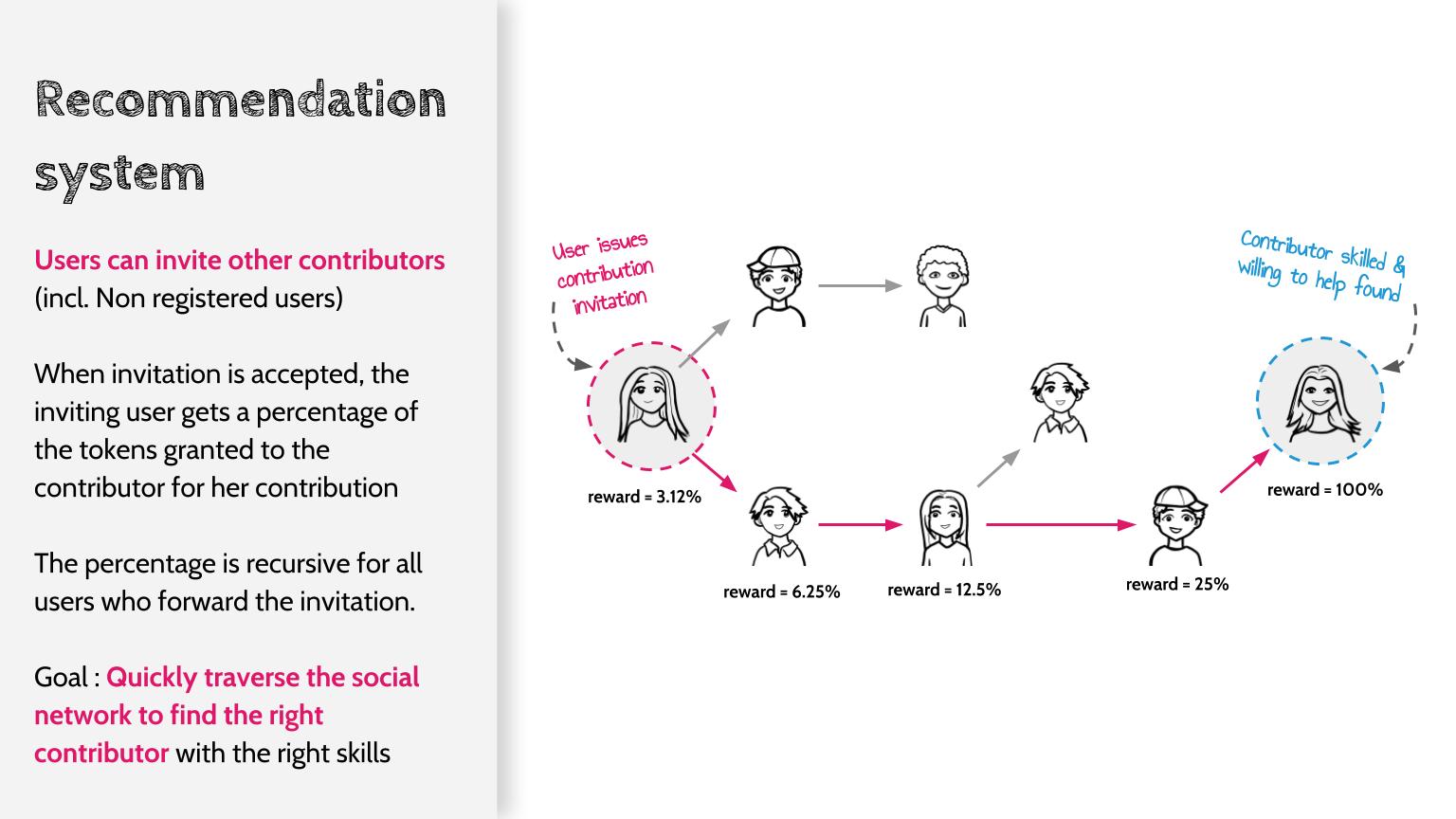

A part of the social media mechanism, a contributor may invite an outside contribution (i.e., from a lurker or someone who has not been exposed earlier to the project). To avoid spam and mass invitation, the inviter has to pay a fee to invite someone (0.1% of the project value in shares at the time of invitation). If the invitee accepts and makes a contribution which in turn is accepted, then the inviter gets his fee back + 25% of the shares earned by the invitee having contributed.

The invitation can pass on recursively with the same “anti-spam” constraints (0.1% of the project value in #SDGs this time) and + 50 % of the shares earned by the invitee. In other words, if the real lurker/contributor at the end of the invitation chain gets 100 shares, the person who invited the the lurker/contributor get 50 shares , the person who invited the person who found the lurker gets 25 shares, and so on. Invitation fees get all reimbursed. Loops are not possible.

If the invited lurker has not previously contributed to the project she gets a 50% bonus in shares. If the invited lurker has no account on the SDG.Market, she immediately gets 10000 #SDGs credited upon creation of her account (this value may change .

- Practical Issues :

- an invitee new to the system should create an account (equiv. a wallet) => one way is to create immediately a wallet per email address. The account can be confirmed later (different emails can be confirmed and consolidated in one account)

- an anti-spam mechanism might be needed, based on peer-review, or by providing a button in the email sent for the invitee to report spam. To deter spam, each invitation may cost a very small fee (0.05). Similarly, a request to contribute shall cost a very small fee (0.05), reimbursed when the contribution is accepted.

Sophisticated Rule :

A sophisticated rule may imply tasks, which get traded as futures : the task issuer makes an offer for achieving a task within a given time period. The future may in turn attract one or many contributors who make a commitment to achieve a task within the given period (see reference XXX for further details).

Rewards for reuse of modules outside of the project:

The whole idea would be that a project sub-divided into modules (bricks), which could adopted or cited by other projects. The idea is to follow attribution and avoid useless replication of knowledge.

Reuse shall be free, however should bring some rewards to the contributors of source project. The proposition is that a module of project A (of value a at the time of reuse) is reused by project B (of value b at the time of reuse), then the shareholders of project A should receive some tokens of project B in proportion of their holdings in project A.

Determination of the amount of shares : If project B has k modules, the additional module is worth 1/(B+1) x total amount of tokens in circulation. For consistency, it could similarly counted in quantity of bytes. Project value should not matter here.

How the SDG Market solves some outstanding issues of setting incentives and work attribution in open collaboration

Ensure that projects can pass on from a generation of contributors to another

The patterns of contribution are different across generations. First generations of contributors tend to produce an intense work for a short lasted time period. With younger generations working less in the instant however for a longer period. The SDG Market factors in value over time.

Intellectual Property Protection

How do we protect intellectual property ?

One the main problem with collective production is how the value of IP is shared among contributors. In particular when contributors act at different stages of a project, the early contributors may make key background efforts, while second or third generation contributions may be in position to make decisive moves and reap off the benefits of the early contributors.

=> plagiarism detection

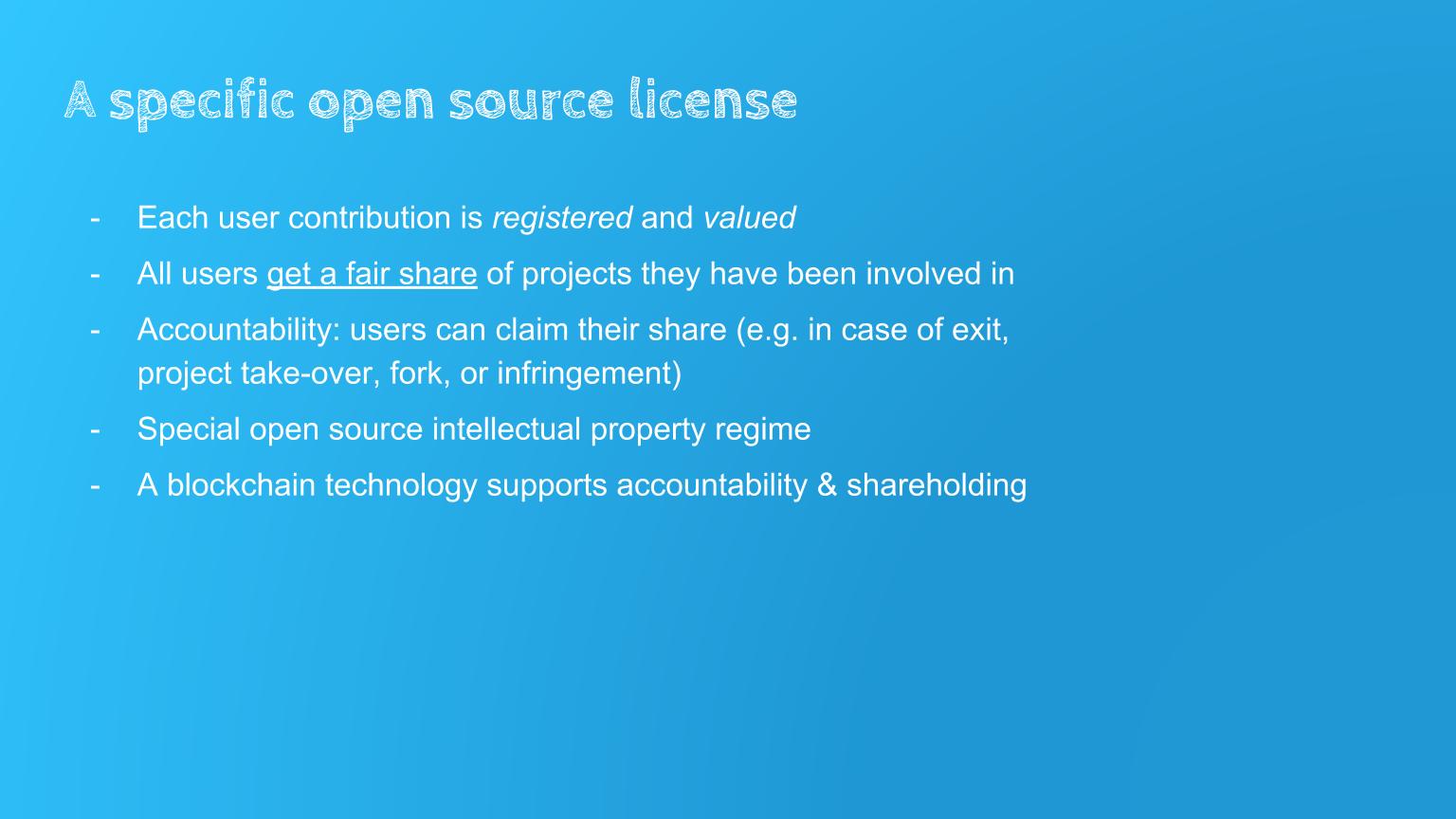

License :

We shall invent a new license that enforces :

- open source

- provisional financial attribution based on share ownership, which itself is based on the contribution & trading trails over the whole history of the project.

Encouragement to Share

…

Misc Chunks (to be removed at some point)

Reuse & Fork:

One should be incentivized to reuse parts of existing projects, or even fork projects following the sharing requirement.

Reuse :

Reuse is free but incumbent content producers should be rewarded for their past work. When content is reused from one project to another, the stockholders of the incumbent projects get shares from the reusing project.

100% of the shares of the latter project and distributed to the individual having performed the reuse. The shares are spread across the shareholders of the incumbent project in proportion of their respective holding in the incumbent project at the time of fork.

Fork :

In case of fork, the initial stock of shares in the latter project is set arbitrarily to 200. The incumbent shareholders share immediately 100 shares of the latter project and the individual having fork gets the other 100.

Valuation starts at 1 and initial capital is 200.

Fork of intermediate versions is possible. Distribution of bonus shares to incumbents is made according the contribution and stock values states at the time of the version.

Fork may for instance allow rebooting a project, which has experienced a governance failure.

Expected behavior : a fork is pure replication of content, which brings no additional information. Therefore, if the project does not bring expectation that it will distinguish itself from the parent project, it should lose traction and thus value fairly quickly. Another more annoying possibility would be that it reaches the same value as the incumbent project (since they both contain the same information). However, this is unlikely because the value of a project entails its capacity to grow and adapt. For that community building is almost required. If the forked project strives within another community, then the fork is a success and the project gets its own value.

A fork may likely imply creating a new (resp. updating) project smart contract

Merge of two projects:

Not clear how we can have a merge happen besides reusing parts of one project to another, and abandoning the former project by selling stocks until project value gets residual.

(I would not advocate for a negotiation based bargain/deal)

Invitations & Recommendation / Pull Requests / Merge :

One way to share resources and effort is to recommend/invite contributors to help for a project.

One way to share resources and effort is to recommend/invite contributors to help for a project.

If an invitee to a project makes a contribution, the recommender gets half of the shares. If the invitation is carried on further, each recommender get half of the shares of her invitee. For example an invitation is carried on 3 steps and the final invitee has contributed and has received 10 shares. The person who has invited her gets 5 shares, the recommender who invited the person who has found the contributor gets 2.5 shares, and so on recursively. This mechanism offers strong incentives to reach out for targeted help, and to further build the community (It was used for the DARPA Grand Balloon Challenge).

It’s all about invitation to contribute (c.f., recommendation above), or a spontaneous request to make a contribution. A request to make a change to a GIST shall be made to the owner or the main contributor of the GIST (to be clarified in details). This request may be presented as an outline of the fostered change, or in the style of a pull request, with a diff already integrated in the request.

If the GIST is part of a project, the contributor which contribution has been accepted shall receive some shares of the project (according to the market value rules, c.f. above). If the accepted contribution follows an invitation, the inviter gets a bonus. If it’s a spontaneous contribution accepted, the contributor gets the same bonus for herself.

If the GIST is not part yet of a project, “foster shares” are counted and registered but they cannot be traded until the project is incorporated with this GIST (and perhaps other GISTs altogether).

Project Membership :

To become a core member of a project, one may achieve a number n of accepted pull requests on GIST by P different project members.n and p may be set by default to p=min(#members,3) and n=5 or they can be customized by project. Larger p and n reflects more extreme vetting.

How to spend the money ?

To make an expenditure, it’s like internal crowdfunding. A proposition for expenditure is made. Then project owners shall contribute their “project cash” (earned from the Tobin tax). If the amount is reached, along with a quorum of contributors (to avoid freeloading), then the purchase is performed.

Blockchain mechanisms

- hashgraph

- GitHub Gist or/and IPFS

Overview of Practical Implementation Strategies :

- Platform developed by Bodo

- PoC contribution management with GitHub as a backend

- PoC blockchain market

- PoC contribution management with IPFS

Next steps :

- review and improvement period for this document (until 31/12/2017)

- presentation at Davos

- European H2020 Grant Application (April) ?

- June 2018 : first working version (with GitHub as backend)

- August 2018 : sdg.market meeting at iSDG Assembly Shenzhen

Initial Funding & Initial Coin Offering (ICO) :

The initial funders of the Foundation (min. 50k) share 10% of SDGcoins issued during the ICO, in proportion of their respective contributions.

ICO : one SDGcoin = $5

After ICO : SDGcoins are issued in function of the number of transactions. Every 1000 (+ \epsilon e.g., 10%, to be further determined) transactions, one SDGcoin is issued and sold at market price by the Foundation.

Verification of transactions also bring coin rewards (tbd, but rather a power law decreasing function that flattens, instead of exponential decay which brings problems as for bitcoin).

Apendices

[future implementation] Delegation of Governance to projects

We start simple enough, but in the future, some rules may be set for each project by the project creator (e.g., share awards for contributions and recommendations. These rules may be changed only with a fork of a project.

Alternative Measures of Contribution

- commits instead of bytes : incentivizes many commits of less quantity (in bytes).